Terms of Use

PLEASE READ THESE TERMS OF USE (“AGREEMENT” OR “TERMS OF USE”) CAREFULLY BEFORE USING THE SERVICES OFFERED BY DEANE CORPORATE FINANCE (“COMPANY”). THIS AGREEMENT SETS FORTH THE LEGALLY BINDING TERMS AND CONDITIONS FOR YOUR AND YOUR BUSINESS OR OTHER LEGAL ENTITY’S (“YOU”) USE OF THE WEBSITES OWNED AND OPERATED BY COMPANY, INCLUDING, WITHOUT LIMITATION, WWW.DEANECORPORATEFINANCE.COM (“SITE”), AND ANY OTHER FEATURES, CONTENT, OR APPLICATIONS OFFERED FROM TIME TO TIME IN CONNECTION THEREWITH (COLLECTIVELY, THE “SERVICE”). BY USING THE SITE OR SERVICE IN ANY MANNER, INCLUDING BUT NOT LIMITED TO VISITING OR BROWSING THE SITE, YOU AGREE TO BE BOUND BY THIS AGREEMENT. THIS AGREEMENT APPLIES TO ALL USERS OF THE SITE OR SERVICE, INCLUDING USERS WHO ARE ALSO CONTRIBUTORS OF CONTENT, INFORMATION, AND OTHER MATERIALS OR SERVICES ON THE SITE. BY ENTERING INTO THIS AGREEMENT ON BEHALF OF A COMPANY OR OTHER LEGAL ENTITY, YOU REPRESENT THAT YOU HAVE THE AUTHORITY TO BIND SUCH ENTITY TO THIS AGREEMENT AND THAT YOU ARE OF LEGAL AGE TO FORM A BINDING CONTRACT.

Acceptance of Terms

The Service is offered subject to acceptance without modification of these Terms of Use and all other operating rules, policies and procedures that may be published from time to time on the Site by Company. In addition, some services offered through the Service are subject to additional terms and conditions promulgated by Company; your use of such services is subject to those additional terms and conditions, which are incorporated into these Terms of Use by this reference.

Modification of Terms of Use

Company reserves the right, at its sole discretion, to modify or replace any of the Terms of Use, or change, suspend, or discontinue the Service (including without limitation, the availability of any feature, database, or content) at any time by posting a notice on the Site or by sending you an email. Company may also impose limits on certain features and services or restrict your access to parts or all of the Service without notice or liability. Any such modification shall be effective immediately. It is your responsibility to check the Terms of Use periodically for changes. Your continued use of the Service following the posting of any changes to the Terms of Use constitutes unconditional acceptance of those changes.

Privacy

Your visit to the Site is also governed by our Privacy Policy. Company’s current privacy policy is located at WEBSITE ADDRESS (the “Privacy Policy”) and is incorporated into these Terms of Use by this reference. For inquiries in regards to the Privacy Policy, or to report a privacy-related problem, please contact info@deanecorporatefinance.com.

Disclaimer

The Company does not make any guarantee or promises as to any results that may be obtained from using the Services. All investments and business strategies entail risks. There is no guarantee that strategies will achieve the desired results under all market conditions and you should make your own independent decision with respect to any course of action in connection herewith and as to whether such course of action is appropriate or proper based on your own judgment. No representation is being made that any account, product, or strategy will or is likely to achieve profits, losses, or results similar to those discussed, if any. To the maximum extent permitted by law, the Company disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

Third Party Sites

The Service may permit you to link to other websites or resources on the Internet, and other websites or resources may contain links to the Sites. When you access third party websites, you do so at your own risk. These other websites are not under Company’s control, and you acknowledge that Company is not responsible or liable for the content, functions, accuracy, legality, appropriateness or any other aspect of such websites or resources. The inclusion of any such link does not imply endorsement by Company or any association with its operators. You further acknowledge and agree that Company shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any such Content, goods or services available on or through any such website or resource.

Rules and Conduct

You may not use the Service for any purpose that is prohibited by these Terms of Use. The Service is provided only for your internal use in connection with your lawful business activities. You are responsible for all of your activity in connection with the Service. For purposes of the Terms of Use, the term “Content” includes, without limitation, any advertisements, advice, suggestions, blogs or forum comments, information, data, text, photographs, software, scripts, graphics, and interactive features generated, provided, or otherwise made accessible by Company or its partners on or through the Service.

By way of example, and not as a limitation, you shall not (and shall not permit any third party to) either (a) take any action or (b) post any content on or through the Service, that:

- infringes any intellectual property or other proprietary right of any other person or entity;

- is unlawful, threatening, abusive, harassing, defamatory, libelous, deceptive, fraudulent, invasive of another’s privacy, tortious, obscene, offensive, or profane;

- constitutes unauthorized or unsolicited advertising, junk or bulk e-mail (“spamming”);

- involves commercial activities and/or sales without Company’s prior written consent, such as contests, sweepstakes, barter, advertising, or pyramid schemes;

- contains software viruses or any other computer codes, files, or programs that are designed or intended to disrupt, damage, limit or interfere with the proper function of any software, hardware, or telecommunications equipment or to damage or obtain unauthorized access to any system, data, password or other information of Company or any third party; or

- impersonates any person or entity, including any employee or representative of Company.

Additionally, you shall not: (i) take any action that imposes or may impose (as determined by Company in its sole discretion) an unreasonable or disproportionately large load on Company’s (or its third party providers’) infrastructure; (ii) interfere or attempt to interfere with the proper working of the Service or any activities conducted on the Service; (iii) bypass any measures Company may use to prevent or restrict access to the Service (or other accounts, computer systems or networks connected to the Service); (iv) run Maillist, Listserv, any form of auto-responder or “spam” on the Service; or (v) use manual or automated software, devices, or other processes to “crawl” or “spider” any page of the Site.

You shall not (directly or indirectly): (i) decipher, decompile, disassemble, reverse engineer or otherwise attempt to derive any source code or underlying ideas or algorithms of any part of the Service, except to the limited extent applicable laws specifically prohibit such restriction, (ii) modify, translate, or otherwise create derivative works of any part of the Service, (iii) copy, rent, lease, distribute, or otherwise transfer any or all of the rights that you receive hereunder, or (iv) use or access the Service in order to build a competitive product or service. You must abide by all applicable local, state, national and international laws and regulations when using the Service.

Company reserves the right to remove any Content from the Site or Service at any time, for any reason (including, but not limited to, upon receipt of claims or allegations from third parties or authorities relating to such Content or if Company is concerned that you may have violated the Terms of Use), or for no reason at all.

Company and Site Content

You acknowledge Site’s exclusive rights in Site’s trademark and service mark. You agree that the Service contains Content specifically provided by Company or its partners and that such Content is protected by copyrights, trademarks, service marks, patents, trade secrets or other proprietary rights and laws. Site and any party that provides intellectual property to Site retain all rights with respect to any of their respective intellectual property appearing in the website and no rights in such materials are transferred or assigned to you. You shall abide by all copyright notices, information, and restrictions contained in any Content accessed through the Service. You shall not sell, license, rent, modify, distribute, copy, reproduce, transmit, publicly display, publicly perform, publish, adapt, edit, create derivative works from, or otherwise exploit any Content or third party submissions or other proprietary rights not owned by you (i) without the consent of the respective owners or other valid right, and (ii) in any way that violates any third party right.

You may, to the extent the Site expressly authorize you to do so, download or copy the Content, and other items displayed on the Site for download, for your internal business use only, provided that you maintain all copyright and other notices contained in such Content. You shall not store any significant portion of any Content in any form. Copying or storing of any Content for other than for your internal business use is expressly prohibited without prior written permission from Company, or from the copyright holder identified in such Content’s copyright notice. You may not modify copy, distribute, display, send, perform, reproduced, publish, license, creative derivative works from, transfer, sell or otherwise infringe on any intellectual property rights related to any information, content, products or services obtained from or otherwise connected to this website.

User Submissions

The Service may also provide you with the ability to post content such as blog comments to the Service. Although some of the individuals posting to the Site work for Company, any opinions expressed are the personal opinions of the original authors, not of Company. The content is provided for informational and entertainment purposes only and is not meant to be an endorsement or representation by Company or any other party. Company assumes no responsibility or liability for any blogs, opinions or other commentary posted on the Site or any website linked to the Site, and makes no express or implied warranty or guarantee about the accuracy, copyright compliance, legality, or any other aspect of such content.

The Site is available to the public. No information you consider confidential should be posted to this Site. If you submit content, you agree that Company may reveal your identity and whatever information we know about you to any law enforcement agent or official in the event of legal action arising from any posting(s) made by you. Company may modify, display, delete, transmit or distribute content posted on the Site in its sole discretion and without your permission. However, Company shall not be responsible for controlling or editing any content, nor can Company ensure prompt removal of inappropriate or unlawful content. You also grant to Company a worldwide, perpetual, irrevocable, royalty-free and fully-paid, transferable (including rights to sublicense) right to fully exercise and exploit all intellectual property, publicity, and moral rights with respect to any content you provide.

By posting you agree to be solely responsible for the content of all information you contribute, link to, or otherwise upload to the Site, and release Company from any liability related to your use of the Site. Company reserves the right, but are not obligated, to monitor materials posted in any public areas. Company reserves the right to remove any content from the Site at any time, for any reason (including, but not limited to, upon receipt of claims or allegations from third parties or authorities relating to such content or if Company is concerned that you may have breached the immediately preceding sentence), or for no reason at all.

Termination

Company may terminate your access to all or any part of the Service at any time, with or without cause, with or without notice, effective immediately, which may result in the forfeiture and destruction of all information associated with your membership. If you wish to terminate your account, you may do so by following the instructions on the Site. All provisions of the Terms of Use which by their nature should survive termination shall survive termination, including, without limitation, ownership provisions, warranty disclaimers, indemnity and limitations of liability.

Warranty Disclaimer

Company makes no representations concerning any Content contained in or accessed through the Site, and Company will not be responsible or liable for the reliability, timeliness, quality, suitability, availability, accuracy, completeness, copyright compliance, legality or decency of any Content or material contained in or accessed through the Site. You should independently verify all Content and other information that you access through the Service. By using the Service, you agree that Company shall not be responsible for (1) any Content, (2) any person’s reliance on any such Content, whether or not correct, current and complete, or (3) the consequences of any action that you or any other person takes or fails to take based on any Content or otherwise as a result of your use of the Service. Your use of or reliance on any Content is at your own risk.

THE SERVICE (INCLUDING, WITHOUT LIMITATION, ANY CONTENT) IS PROVIDED “AS IS” AND “AS AVAILABLE.” YOU AGREE THAT THE USE OF THIS SITE IS AT YOUR SOLE RISK. SITE DISCLAIMS WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF TITLE, NON-INFRINGEMENT, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE, AND ANY WARRANTIES IMPLIED BY ANY COURSE OF PERFORMANCE OR USAGE OF TRADE. COMPANY, AND ITS DIRECTORS, EMPLOYEES, AGENTS, SUPPLIERS, PARTNERS AND CONTENT PROVIDERS DO NOT WARRANT THAT: (A) THE SERVICE WILL BE SECURE OR AVAILABLE AT ANY PARTICULAR TIME OR LOCATION; (B) THE USE OF THE SERVICE WILL BE SECURE, TIMELY, UNINTERRUPTED OR ERROR-FREE, OR OPERATE IN COMBINATION WITH ANY OTHER HARDWARE, SOFTWARE, SYSTEM OR DATA; (B) ANY DEFECTS OR ERRORS WILL BE CORRECTED; (C) ANY CONTENT OR SOFTWARE AVAILABLE AT OR THROUGH THE SERVICE IS FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS; OR (D) THE RESULTS OF USING THE SERVICE WILL MEET YOUR REQUIREMENTS OR EXPECTATIONS. YOUR USE OF THE SERVICE IS SOLELY AT YOUR OWN RISK. THE SERVICES MAY BE SUBJECT TO LIMITATIONS, DELAYS, AND OTHER PROBLEMS INHERENT IN THE USE OF THE INTERNET AND ELECTRONIC COMMUNICATIONS, AND COMPANY IS NOT RESPONSIBLE FOR ANY DELAYS, DELIVERY FAILURES, OR OTHER DAMAGE RESULTING FROM SUCH PROBLEMS.

SOME STATES DO NOT ALLOW LIMITATIONS ON HOW LONG AN IMPLIED WARRANTY LASTS, SO THE ABOVE LIMITATIONS MAY NOT APPLY TO YOU. YOUR SOLE AND EXCLUSIVE REMEDY RELATING TO YOUR USE OF SITE SHALL BE TO DISCONTINUE USING THE SITE.

ELECTRONIC COMMUNICATIONS PRIVACY ACT NOTICE (18 USC 2701-2711): COMPANY MAKES NO GUARANTY OF CONFIDENTIALITY OR PRIVACY OF ANY COMMUNICATION OR INFORMATION TRANSMITTED ON THE SITE OR ANY WEBSITE LINKED TO THE SITE. Company will not be liable for the privacy of email addresses, registration and identification information, disk space, communications, confidential or trade-secret information, or any other Content stored on Company’s equipment, transmitted over networks accessed by the Site, or otherwise connected with your use of the Service.

Indemnification

You shall defend, indemnify, and hold harmless Company, its affiliates and each of its, and its affiliates employees, contractors, directors, suppliers and representatives from all liabilities, claims, and expenses, including reasonable attorneys’ fees, that arise from or relate to (i) your use or misuse of, or access to, the Site, Service, Content, or otherwise from any content that you post to the Site, (ii) your violation of the Terms of Use, or (iii) infringement by you, or any third party using the your account, of any intellectual property or other right of any person or entity. Company reserves the right to assume the exclusive defense and control of any matter otherwise subject to indemnification by you, in which event you will assist and cooperate with Company in asserting any available defenses.

Limitation of Liability

IN NO EVENT SHALL COMPANY, NOR ITS DIRECTORS, EMPLOYEES, AGENTS, PARTNERS, SUPPLIERS OR CONTENT PROVIDERS, BE LIABLE UNDER CONTRACT, TORT, STRICT LIABILITY, NEGLIGENCE OR ANY OTHER LEGAL OR EQUITABLE THEORY WITH RESPECT TO THE SERVICE (INCLUDING, WITHOUT LIMITATION, ANY CONTENT) (I) FOR ANY LOST PROFITS OR LOSS OF BUSINESS, DATA LOSS, COST OF PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES, OR SPECIAL, INDIRECT, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES OF ANY KIND WHATSOEVER (HOWEVER ARISING), (II) FOR ANY BUGS, VIRUSES, TROJAN HORSES, OR THE LIKE (REGARDLESS OF THE SOURCE), (III) FOR YOUR RELIANCE ON THE SERVICE OR (IV) FOR ANY DIRECT DAMAGES IN EXCESS OF (IN THE AGGREGATE) ONE-HUNDRED U.S. DOLLARS ($100.00) OR, IF GREATER, THE FEES PAID BY YOU FOR THE SERVICE IN THE PRECEDING SIX (6) MONTH PERIOD. SOME STATES DO NOT ALLOW THE EXCLUSION OR LIMITATION OF INCIDENTAL OR CONSEQUENTIAL DAMAGES, SO THE ABOVE LIMITATIONS AND EXCLUSIONS MAY NOT APPLY TO YOU.

Dispute Resolution

A printed version of the Terms of Use and of any notice given in electronic form shall be admissible in judicial or administrative proceedings based upon or relating to the Terms of Use to the same extent and subject to the same conditions as other business documents and records originally generated and maintained in printed form. You and Company agree that regardless of any statute or law to the contrary, any cause of action arising out of or related to the Service must commence within one (1) year after the cause of action arose; otherwise, such cause of action is permanently barred.

The Terms of Use shall be governed by and construed in accordance with the laws of the State of New York, excluding its conflicts of law rules. Any dispute arising from or relating to the subject matter of this Agreement shall be finally settled by arbitration in New York, New York, using the English language in accordance with the Arbitration Rules and Procedures of Judicial Arbitration and Mediation Services, Inc. (“JAMS”) then in effect, by one commercial arbitrator with substantial experience in resolving intellectual property and commercial contract disputes, who shall be selected from the appropriate list of JAMS arbitrators in accordance with the Arbitration Rules and Procedures of JAMS. The prevailing party in the arbitration shall be entitled to receive reimbursement of its reasonable expenses (including reasonable attorneys’ fees, expert witness fees and all other expenses) incurred in connection therewith. Judgment upon the award so rendered may be entered in a court having jurisdiction or application may be made to such court for judicial acceptance of any award and an order of enforcement, as the case may be. Notwithstanding the foregoing, each party shall have the right to institute an action in a court of proper jurisdiction for injunctive or other equitable relief pending a final decision by the arbitrator. For all purposes of this Agreement, the parties consent to exclusive jurisdiction and venue in the United States Federal Courts located in the Eastern District of Pennsylvania. Use of the Service is not authorized in any jurisdiction that does not give effect to all provisions of the Terms of Use, including without limitation, this section.

Integration and Severability

The Terms of Use are the entire agreement between you and Company with respect to the Service and use of the Site, and supersede all prior or contemporaneous communications and proposals (whether oral, written or electronic) between you and Company with respect to the Site. If any provision of the Terms of Use is found to be unenforceable or invalid, that provision will be limited or eliminated to the minimum extent necessary so that the Terms of Use will otherwise remain in full force and effect and enforceable. The failure of either party to exercise in any respect any right provided for herein shall not be deemed a waiver of any further rights hereunder. Any waiver of these Terms by Company must be in writing and signed by an authorized representative of Company.

Miscellaneous

Company shall not be liable for any failure to perform its obligations hereunder where such failure results from any cause beyond Company’s reasonable control, including, without limitation, mechanical, electronic or communications failure or degradation (including “line-noise” interference). The Terms of Use are personal to you, and are not assignable, transferable or sub-licensable by you except with Company’s prior written consent. Company may assign, transfer or delegate any of its rights and obligations hereunder without consent. No agency, partnership, joint venture, or employment relationship is created as a result of the Terms of Use and neither party has any authority of any kind to bind the other in any respect. In any action or proceeding to enforce rights under the Terms of Use, the prevailing party will be entitled to recover costs and attorneys’ fees. All notices under the Terms of Use will be in writing and will be deemed to have been duly given when received, if personally delivered or sent by certified or registered mail, return receipt requested; when receipt is electronically confirmed, if transmitted by facsimile or e-mail; or the day after it is sent, if sent for next day delivery by recognized overnight delivery service.

Contact

You may contact Company via email to info@deanecorporatefinance.com.

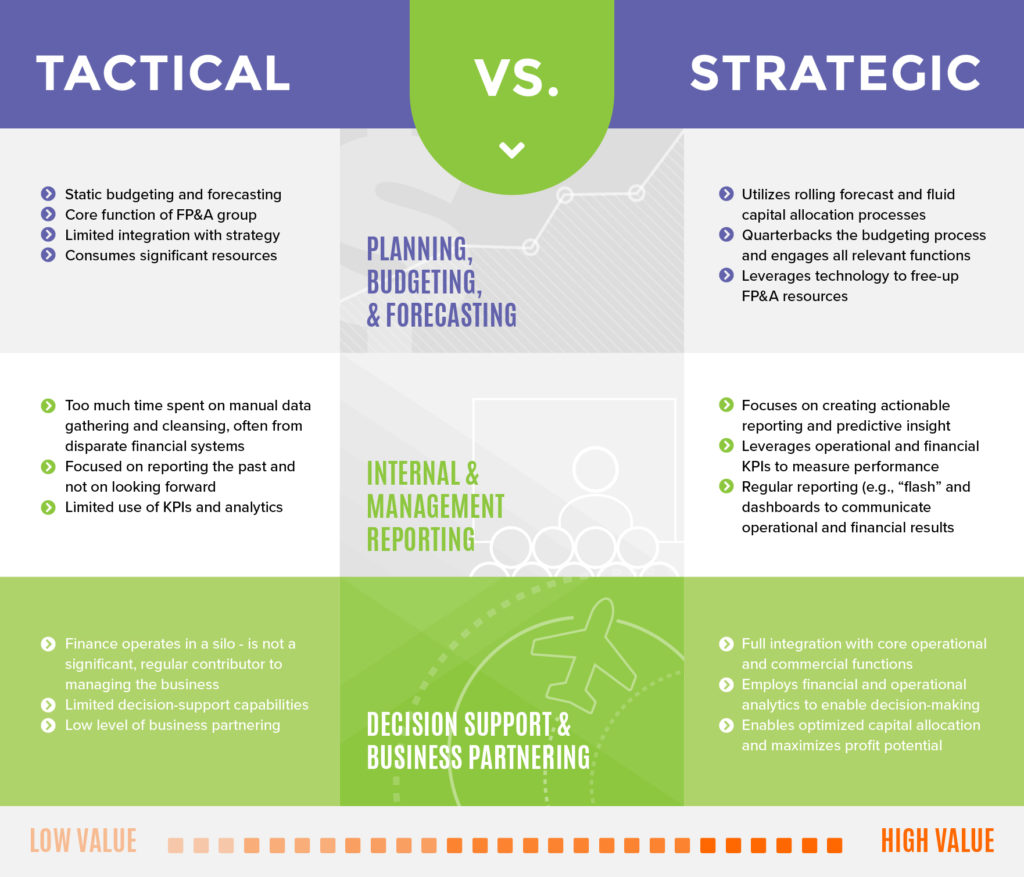

Over the past several years, the role of the finance team in corporate organizations has evolved considerably. Traditional responsibilities included accounting, financial reporting, audit and compliance, treasury, etc. While these functions remain critical, changes in global economics, technology, regulation, and other business-critical factors have caused companies to demand more from their finance teams. In fact, it’s not uncommon for companies to view these functions as pure cost centers. This puts them in the crosshairs of cost rationalization and implementation of effectiveness measures. It’s not surprising, then, that the office of the CFO is, with increasing frequency, being called upon to assume a more prominent role as strategist and operator (in addition to the traditional roles). Said another way – corporate finance teams can no longer exist as a cost center; they must contribute to the creation of enterprise value (through FP&A).

Over the past several years, the role of the finance team in corporate organizations has evolved considerably. Traditional responsibilities included accounting, financial reporting, audit and compliance, treasury, etc. While these functions remain critical, changes in global economics, technology, regulation, and other business-critical factors have caused companies to demand more from their finance teams. In fact, it’s not uncommon for companies to view these functions as pure cost centers. This puts them in the crosshairs of cost rationalization and implementation of effectiveness measures. It’s not surprising, then, that the office of the CFO is, with increasing frequency, being called upon to assume a more prominent role as strategist and operator (in addition to the traditional roles). Said another way – corporate finance teams can no longer exist as a cost center; they must contribute to the creation of enterprise value (through FP&A).